[ad_1]

The Division of Vitality (DOE) on Friday issued proposed steering on international battery content material in EVs that might minimize the federal tax credit score for some fashions. Nevertheless it additionally offers a clearer image for automakers and battery suppliers.

Beginning Jan. 1, EVs are ineligible for the federal tax credit score of as much as $7,500 if they’ve key battery parts sourced from a “international entity of concern.” The exclusion initially applies to manufacturing and meeting or battery parts, however extends to mining, processing, and recycling of crucial minerals in 2025.

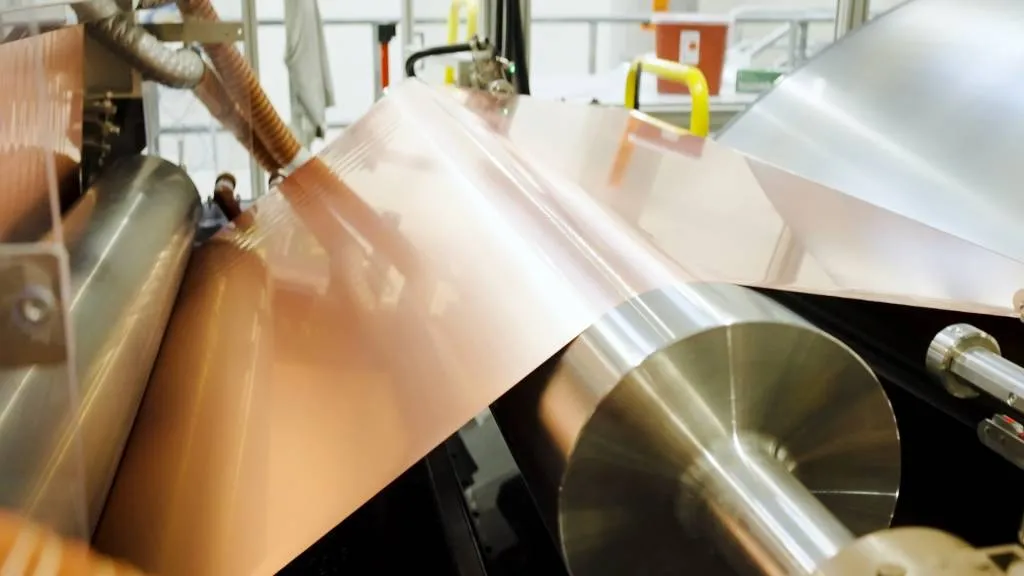

Mercedes-Benz Alabama battery manufacturing unit

The entities lined by this steering embrace corporations or different organizations “owned by, managed by, or topic to the jurisdiction or course of a authorities of a international nation that may be a lined nation.” The “lined nations” embrace China, Russia, Iran, and North Korea.

The exclusion additionally applies to company subsidiaries if a “mum or dad entity” straight holds greater than 50% of the subsidiary’s “board seats, voting rights, or fairness curiosity.” So whereas most EVs bought within the U.S. have American-made batteries, and plenty of automakers are planning elevated U.S. meeting to adjust to current tax-credit guidelines, the foreign-entity-of-concern provision will as soon as once more tighten which EVs qualify for a credit score.

Toyota and Redwood Supplies battery recycling

Based on current reporting, for instance, Chinese language automaker Geely owns roughly a 79% curiosity in Volvo. So some fashions from Volvo and its spinoff model Polestar could be affected by this regardless of U.S. meeting. The Volvo EX90 electrical SUV in any other case regarded prefer it may qualify for a tax credit score because of South Carolina meeting and a base value just under the $80,000 value cap for SUVs set out within the present guidelines.

Volvo Automotive USA declined touch upon the matter, however recommended looking for remark from Autos Drive America, an advocacy and commerce group that claims membership by a spread of international automakers. Inexperienced Automotive Studies is awaiting clarification on the way it may have an effect on among the group’s member-clients.

Final 12 months the White Home clarified that battery supplies sourced from Japan, South Korea, Europe, and others could be tax-credit eligible. Not too long ago quite a few automakers have additionally acted to arrange round provide chains inside the U.S. to verify their home battery content material is greater as a hedge towards international battery-content guidelines. Toyota, as an example, is working with Redwood Supplies to faucet recycled Prius battery supplies for future U.S. EV batteries.

—

with extra reporting by Bengt Halvorson

[ad_2]

Supply hyperlink